Some Ideas on P3 Accounting Llc You Need To Know

Wiki Article

The Single Strategy To Use For P3 Accounting Llc

Table of ContentsGet This Report about P3 Accounting LlcRumored Buzz on P3 Accounting LlcThe Main Principles Of P3 Accounting Llc 3 Easy Facts About P3 Accounting Llc ExplainedGetting The P3 Accounting Llc To Work

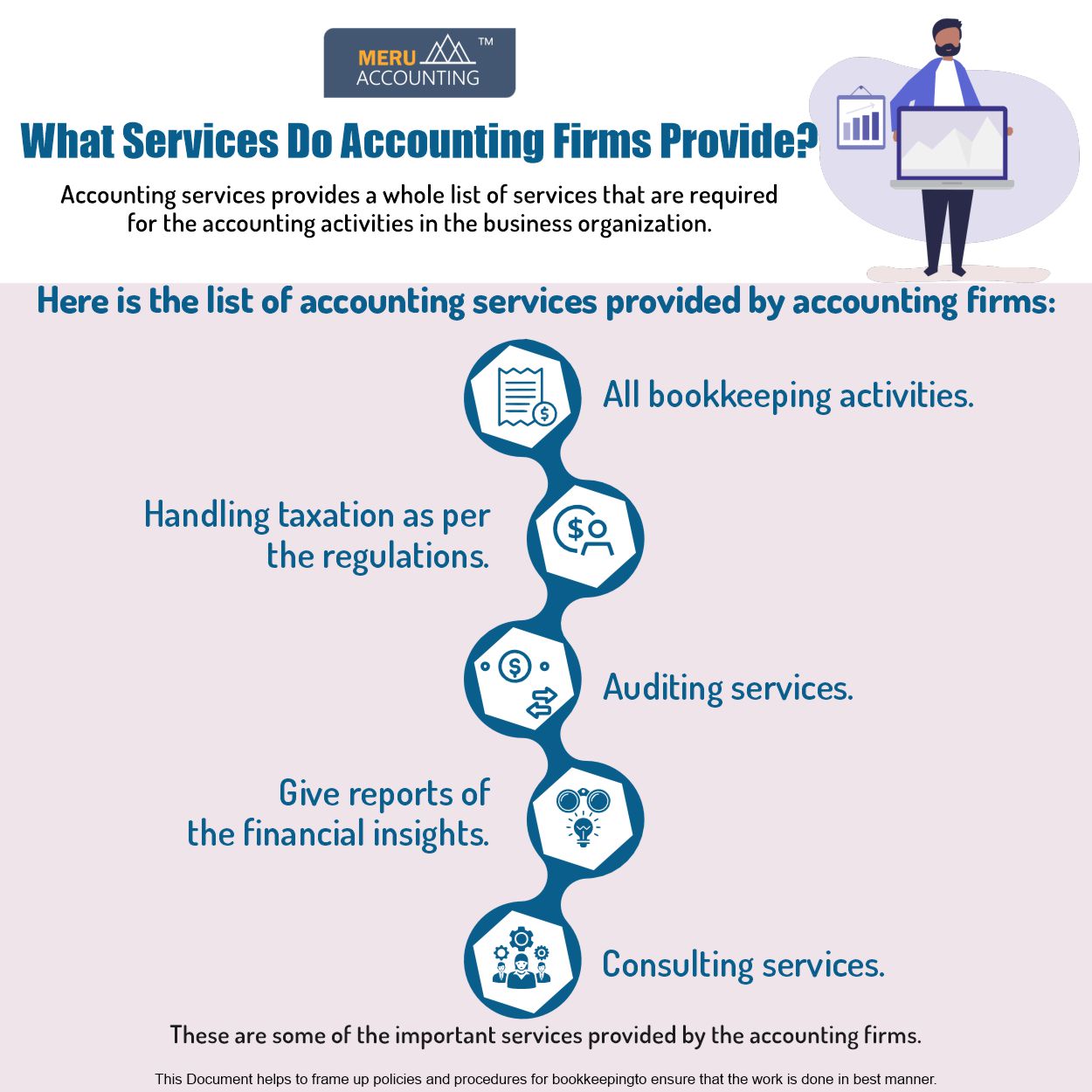

We have a team of over 200 experts with varied backgrounds. We focus on supplying accountancy options to expert service companies. We use greater than 2 loads specialized market method groups with deep understanding and broad experience in these industries: Literary Services; Agencies; Innovation, Internet, Media and Entertainment; Building And Construction; Production, Retailing and Circulation; Maritime, and Cost Partition Groups.By Kimberlee Leonard Updated March 04, 2019 Bookkeeping companies offer a myriad of solutions that aid company owner remain financially arranged, tax obligation certified which assistance prepare for service growth. Company owner shouldn't look at an accountancy company merely as an outsourcing expense for accounting yet as an essential company companion.

While some accountancy firms specialize in particular niche solutions such as tax technique, most will offer bookkeeping and pay-roll solutions, tax obligation preparation and service evaluation services. There is much more to strain preparation and prep work than completing tax obligation returns, although audit firms prepare both state and federal company tax obligation returns. Audit companies additionally prepare year-end company files, such as internal revenue service proprietor K-1, staff member W-2 and 1099-Misc forms.

Furthermore, company owner require to develop organization entities that create most beneficial tax obligation circumstances. Accounting firms aid identify the ideal remedies which aid in the development of entities that make the very best tax sense for the firm. Some estate preparation demands are unique to several company owner, and a bookkeeping company assists recognize these.

P3 Accounting Llc Things To Know Before You Get This

Companies will certainly collaborate with estate planning attorneys, financial coordinators and insurance coverage representatives to implement lasting approaches for service transfers and to alleviate estate tax obligations. Lots of business proprietors are terrific at providing the services or product that is the backbone of business. Organization owners aren't constantly professionals at the economic aspects of running a company.Copies of service savings account can be sent to bookkeeping firms that work with accountants to preserve accurate cash money circulation records. Accounting companies also develop profit and loss declarations that damage down key locations of expenses and profits streams (https://protective-push-450.notion.site/P3-Accounting-LLC-Your-Premier-Accounting-Firm-in-OKC-7fb5433e57e848eaa7c061f8ef284cc8?pvs=4). Accountancy firms additionally may help with accounts receivable and take care of outbound monies that include vendor settlements and payroll processing

Accountancy companies are integral when a company requires to develop valuation records or to acquire audits that funding companies need. When an organization seeks a funding or funding from a personal financier, this deal requires to be properly and accurately valued. It is likewise essential for prospective mergers or acquisitions.

Some accountancy companies additionally aid brand-new businesses with pro forma financial declarations and forecasts. OKC tax credits. Pro forma financials are used for initial funding or for company development. Audit companies use sector information, along with existing company economic history, to compute the information

P3 Accounting Llc for Beginners

The Big 4 also use digital change getting in touch with to serve the demands of business in the electronic age. The "Big Four" describes the four biggest accounting firms in the U.S.The largest accounting firms utilized to consist of the "Big Eight" yet mergers and closures have actually lowered the variety of top rate business.

or U.K. entities. Arthur Youthful integrated with Ernst & Whinney while Deloitte Haskin & Sells merged with Touche Ross to reduce the team matter to 6. Rate Waterhouse and Coopers & Lybrand combined their methods, making the complete 5. Complying with the collapse of Arthur Andersen, because of its tested guilt in the Enron rumor, the 5 became the present-day four.

The Facts About P3 Accounting Llc Revealed

The vast majority of Fortune 500 firms have their financial statements investigated by among the Big 4. Big Four clients include such business giants as Berkshire Hathaway, Ford Electric Motor Co., Apple, Exxon Mobil, and Amazon. According to a 2018 report by the CFA Institute, 30% of the S&P 500 were examined by Pw, C, 31% by EY, 20% by Deloitte, and 19% by KPMG.With 360-degree views of firms and industries, the Big Four are authorities in business. They have substantial recruiting and training programs for fresh grads and provide valued channels for tax obligation and consulting experts to and from numerous industrial fields. Each Big Four company is a composition of individual expert services networks instead of a single company.

Regardless of total firm development, Deloitte's 2021 USA earnings declined from 2020. In 2021, Pw, C reported yearly income of $45. 1 billion, the second highest quantity for Big 4 companies however just up 2% (in its local currency) from the year prior. Earnings in the USA stayed flat, though Pw, C is presently spending $12 billion to add 100,000 new work over the following five years to reinforce its international existence.

Throughout fiscal year 2021, Ernst & Young reported approximately $40 billion of company-wide revenue, a rise of 7. 3% substance yearly growth over the previous seven years.

Report this wiki page